The problems in South Africa cannot be overstated & I don’t wish to agonize over the root cause of the problems, they are well documented. I believe Sweden & South Africa have vast similarities when it comes to governance & economic structure. I believe the economic solutions used by Sweden back in the 1990s when their economy crashed could be used in South Africa given the Overton Window presented by COVID — ceteris paribus.

South Africa vs Sweden

Governance:

- Both countries use the party-proportional representation voting system.

- Both countries have a high level of union membership influence in the public & private sectors (71% of workers are unionized in Sweden)

- Both are welfare states (South Africa & Sweden are mixed economies)

Economy:

- Both countries main component of GDP comes from Services

- Both countries still have a reliance on mineral resource exports.

- Both have a high-income tax rate (top tier is 45% in South Africa & 60.2% in Sweden)

As expected if you lived in Sweden you would:

- Make 3.8 times more money (GDP per capita)

- Be 76.1% less likely to be unemployed (27.6% in SA vs 6.6% in Sweden) – 2019

- Be 17.6% more likely to have access to electricity (I think it’s more)

- Be 69.5% more likely to have access to the internet

But… you would still:

- Spend 26.9% more in taxes

- Spend more on education

- Spend 8.3 times more on healthcare

That being said, comparing statistics is not always an accurate measure of similarities &/or dissimilarities. There are certain nuances that make each country different, some tangible & intangible items that make comparables difficult. For instance, I am quite sure that everyone looks the same in Sweden.

Nevertheless, Sweden is a well-run country & I want to emphasize what worked in Sweden that could work in South Africa from a policy point of view that encapsulates socio-economic decisions that help move a country from a deep recession to one that has low unemployment, a government surplus & a high functioning technology environment while being fairly socialist.

Sweden in the 1990s

Sweden is a country with a population of 10 million people, a GDP of $531 billion & a GDP per capita of $51 945. The country runs a government surplus of $35 billion while spending 48% of GDP on social welfare. Sweden is ranked number 2 in the Global Innovation rankings & have been voted the 3rd best country to live in (despite having the highest income tax rate in the world).

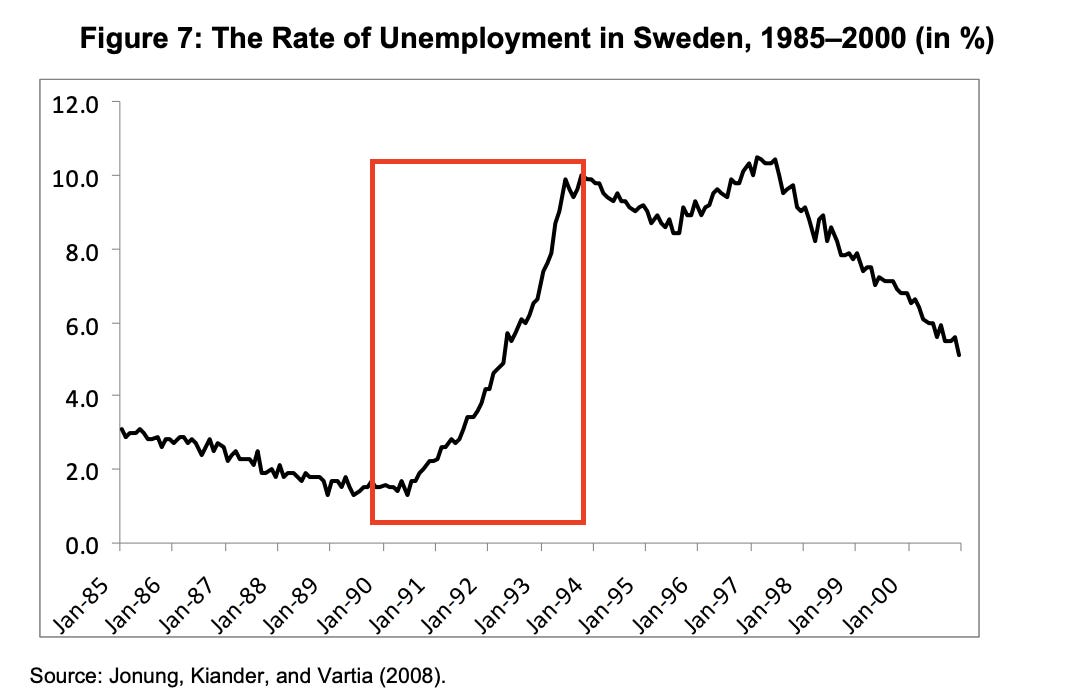

Between 1990 & 1993 the Swedish economy contracted by 5%.Unemployment increased drastically, property prices went out of control & the banking system was crumbling. This was due to a period of wage & price instability & deregulation of credit in the 70s & 80s. These were the boom years that ultimately resulted in a banking crisis in 1992.

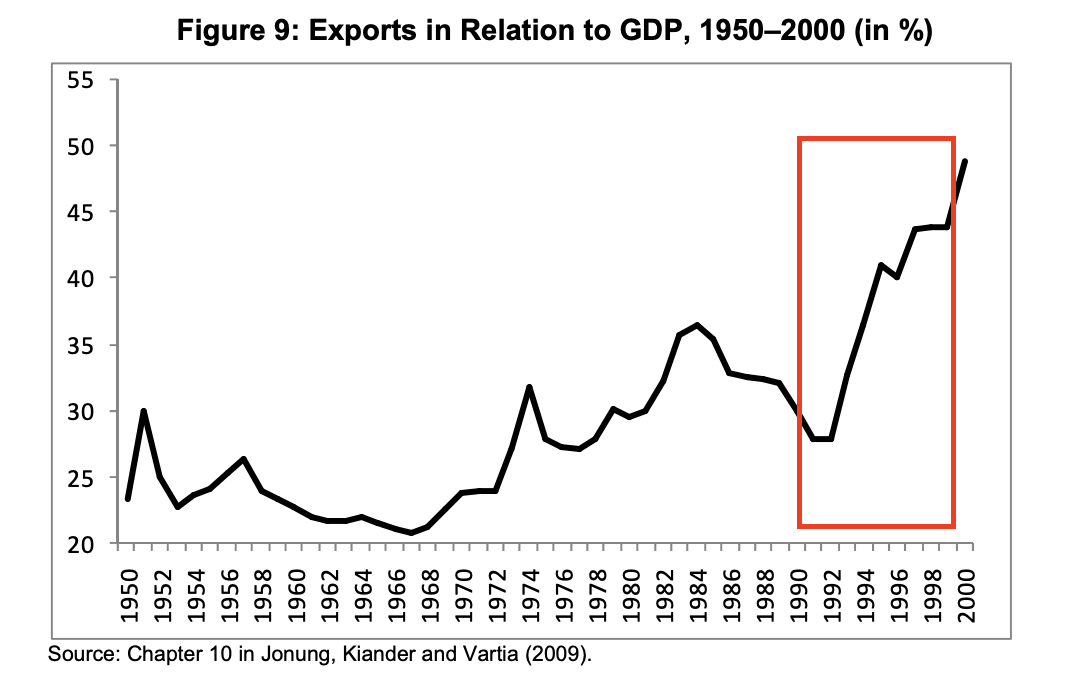

In 1992 interest rates rose by 500% due to the Swedish currency (the Krona) being pegged against the Euro. This led to the deregulation of the Krona by the Riksbank (Reserve Bank). In 1993 the Riksbank moved from a policy of exchange rate control to inflation targeting (like South Africa). With a now floating, weaker currency Sweden was able to export at competitive prices. But, their businesses were going bankrupt and their banking system was still in financial distress.

Stockholm Solution: Bankstödsnämnd

At the end of 1992, the banking system was collapsing. The Centre-right party that was in power together with their polar-opposite-opposition party, the Socialist Democratic party voted with an overwhelming majority to take ownership in major banks.

Bankstödsnämnd had three mandates: 1. Support Nordbank who held the majority of the loans given to businesses. 2. Administrator guarantees & 3. Establish bad banks Retriva & Securum for unwinding the bad debts. Securum went on to manage 5 IPOs & prove the success of how an independently established management company can act swiftly in turning around state-owned enterprises.

Recovery

Deregulation

The market conditions of the 1990s led a series of deregulation & a push towards privatisation of state-owned enterprises. Many state monopolies were deregulated: taxis, electricity, railways & air travel. Anti-competitive behaviours were disregarded through the Competition Act of 1993 that blocked big mergers. The government invested in broadband infrastructure to make sure everyone in the country had access to the Internet.

Tax Reform

Corporate taxes went down from 52% in 1990 to 22% today, Income tax went down from 85% to 57%. In 2000, Sweden got rid of inheritance tax.

Technology & Business Innovation through Policy

Not only did the government of Sweden invest in broadband infrastructure to make access to the internet ubiquitous but they did it early. A softening in foreign exchange control resulted in Foreign Direct Investment (FDI) with the technology boom. Between 2000 & 2014 Sweden saw exits of 263 companies to the value of $23 billion. Companies such as Spotify, Klarna, iZettle & King — the maker of Candy Crush became billion-dollar companies in the last decade.

An academic paper published in 2016 claimed that Sweden is now more entrepreneurial than the US. The growth rate is staggering. Heyman et al. (2016) found that firms aged 5 years & younger constituted 55% of all active firms per annum, over several decades.

In this case, correlation does imply causation.

Lessons for South Africa:

- Welfare states can still implement capitalistic policies to increase growth.

- Cooperation of parliament is important in order to make swift changes.

- Inflation targeting is the correct mandate but more needs to be done by the Reserve bank.

- The government should sell down its ownership stake to minority levels in State-Owned Enterprises.

- An independent body should be established to unwind the ownership in a strict timeline.

- Deregulation increased competition & government revenue.

- The only way 4IR works is if the government invests in the infrastructure & implements investor-friendly policy — concurrently.

I believe South Africa & Sweden’s similarities far outway the dissimilarities. Yes, people in Sweden have a similar culture. Yes, Sweden has a population of 10 million people vs South Africa’s 57 million. Yes, Sweden benefits highly from its proximity to the EU. But, looking at the governance structure & macroeconomic policies, the correlation in structure & policy can be interchangeable due to the similarities in governance & economics.

Take care.

By Ububele Kopo