1979 – Whitey Basson & 8 Stores Ran by Barney Rogut

Whitey Basson was working for PEPkor’s Founder & CEO Renier van Rooyen as CFO of PEPkor, a discount clothing retailer founded in 1965. He had grown tired of running the balance sheet of a publicly listed company & wanted a fresh start.

Whitey was born James Wellwood Basson in 1946 in a small town of Porterville, Western Cape, just north-east of Cape Town. Whitey studied accounting at the University of Stellenbosch. After completing his accounting articles he joined PEPkor as their Financial Director & Head of Operations (CFO) in 1974 at the tender age of 28.

Whitey had a particular skill that would set him apart as an exceptional CEO later in his life. He was extremely good at negotiating & buying distressed companies. After he heard that PEPkor’s financial statements were being leaked to his rival Sam Stupple who ran The Half Price Group, a PEPkor competitor in discount clothing, Whitey started a rumour that PEP was going in groceries. Afraid, Sam Stupple applied for a license to beat PEP to the punch but that tactic put the company in financial distress & Whitey bought The Half Price Group for cents on the dollar (rands in our case).

At the age of 33, Whitey wanted a new challenge. He believed there was a gap in the market of serving the black population (that was being oppressed by the Apartheid government I might add) with consumer packaged goods. Like PEPkor did with clothes, making them affordable to the masses, Whitey wanted to do so with everyday goods & groceries. His strategy was rather than build organically, he would gain scale by buying distressed grocers & refocusing them towards the mass population.

So in 1979 Whitey had found his first target; an 8 store grocery chain ran by Barney Rogut & his family in the Western Cape. Whitey approached PEPkor’s board of directors to get the go-ahead to buy the grocery chain & install himself as CEO of the new company. In November of that year, Whitey bought the 8 stores for 1 million rands (30 million rands in today’s value) from the Roguts & so the journey of the new Shoprite began.

The 1980s – Strategy & the Art of Hustle

Having established the strategy of focusing on the mass underserved population, Whitey & Shoprite targeted the Northern Cape, Free State & Limpopo as the new markets outside of the Western Cape. In 1981 Whitey got a new boss at parent company PEPkor. The flamboyant Christo Wiese had bought out his cousin Renier van Rooyen’s shares & assumed control of PEPkor as Chairman & by virtue, control of Shoprite too. Christo pushed Whitey to grow using his person wealth & the balance sheet of PEPkor.

In 1984 Shoprite purchased 6 Ackermann’s grocers in a deal that saw PEPkor takeover 34 Ackermann’s Clothing stores from Edgars. By 1986 Shoprite at 33 outlets in various provinces & had an IPO on the JSE at a valuation of 29 million rands (349 million rands in today’s value).

Shoprite was the younger sibling of PEPkor but as a public company, Shoprite hustled & hacked its way to scale. Because of their target market, landlords did not want Shoprite in their malls. Whitey decided if the company was to scale they needed to move away from the malls & establish a presence as free-standing grocery stores in city centres. The preferred strategy for Shoprite was to grow via acquisitions of smaller grocery chains but when they could not they targeted free-standing property near city centres. The reason; Shoprite knew that their market did not live in towns but on the periphery due to spacial inequality brought about by Apartheid laws. The best way to get their customers is on their way home; in city centres near the taxi rank. Shoprite would amass a portfolio of 40 free-standing stores in the years to come.

The 1990s – Expansion, Mergers & Acquisitions

At the turn of the decade, South Africa was still under Apartheid rule but Nelson Mandela was released on the 11th of February 1990. Around that time, Whitey was walking through a Grand Bazaars store, a subsidiary of Metro Cash & Carry. MCC & Grand Bazaars was run by a guy called Carlos Dos Santos. Whitey noticed that some of their fridges were turned off & they only sold coke products. In retail, how full your fridges are, determines how much money the store makes because beverages are high margin goods & a profit driver. Whitey called Carlos to buy Grand Bazaars & they made a deal. Shoprite instantly gained 71 more stores.

In 1991, not even a year after buying Grand Bazaars, Whitey had his eye on Checkers. One of the largest upmarket retailers in the country. Whitey was afraid that Raymond Ackermann CEO of Pick n Pay & South Africa’s version of Sam Walton, would buy it before him. Ackermann was once the Chief Executive at Checkers before he was fired. Whitey & Christo with the help of Marinus Daling, Chairman of Sanlam, one of South Africa’s biggest insurance companies, orchestrated a reverse merger that saw Shoprite takeover Checkers. A deal worth 55 million rands (328 million rands in today’s value). Checkers had been losing 45 million rands a year while being owned by Sanlam. The scale of Checkers gave Shoprite 241 stores.

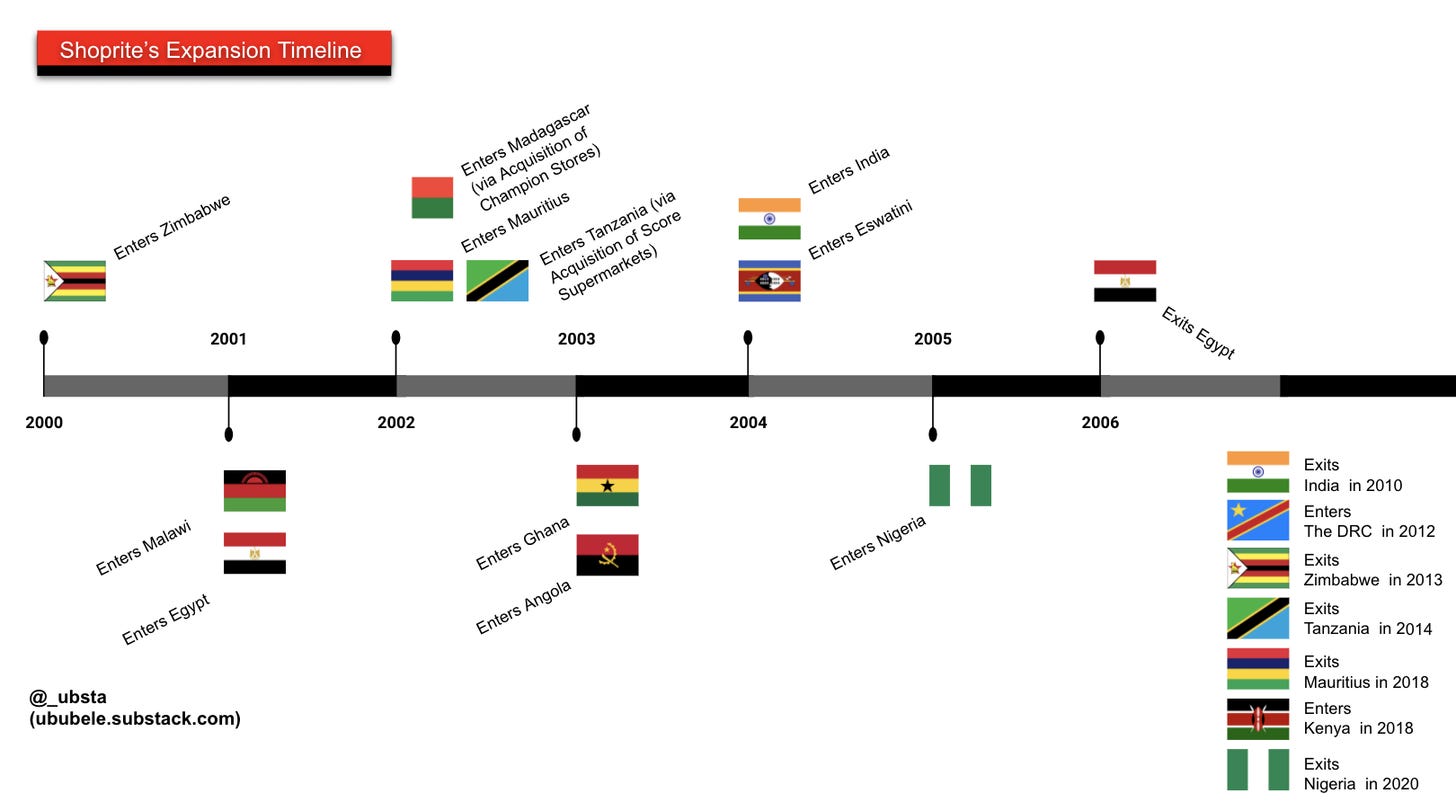

After 1994 Shoprite expanded aggressively in the SADC region opening stores in Lusaka, Zambia in 1996, Maputo, Mozambique in 1997 & Botswana in 1998.

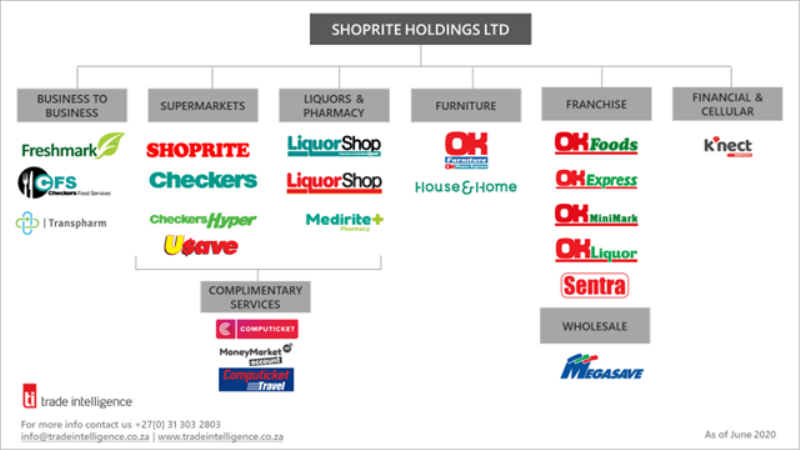

During the same period, Shoprite bought a distribution centre & technology company called Sentra which proved pivotal for Shoprite. They learnt how distribution centres worked with small convenience stores. This allowed the company to be agile for years to come.

Whitey did not stop doing deals. In 1997 he made one of South Africa’s most famous deals; He bought one of his biggest retail groups in the country for 1 rand; The OK Bazaars deal. The OK Bazaars Group operated 157 supermarkets & 146 furniture stores across the country.

Whitey closed the century with the acquisition of Transpharm, a wholesaler & distributor of pharmaceutical products & started the 21st century with over 600 stores split between Shoprite, Checkers & The OK Franchise.

Image source: Shoprite. Whitey just bought The OK Group for R1

The 2000s – Investing in Technology & Further Expansion

In 2000 Shoprite bought Freshmark Systems, a procurement & inventory management system for fresh produce. Freshmarket pioneered fresh produce technology in 1987. The acquisition allowed Shoprite to optimise fresh produce management while scaling its distribution centres.

Shoprite added ticking to its group of companies through the acquisition of Computicket & Computicket Travel from Media24 in 2005. The rationale for this was that the majority of their customers were purchasing travel tickets in stores & the acquisition of Computicket would give the group online exposure & scale in travel buying, plus more customers. Shoprite created Money Money kiosks for travel tickets in 1998 & layered additional financial services like airtime, funeral plan payments, prepaid electricity, Lottery scratch cards & Landline account payment.

This is South Africa we can’t forget Black Empowerment deals (BEE). Shoprite made a franchise empowerment deal in 2004 with Khula Development Finance, an empowerment vehicle by Xola Sitole.

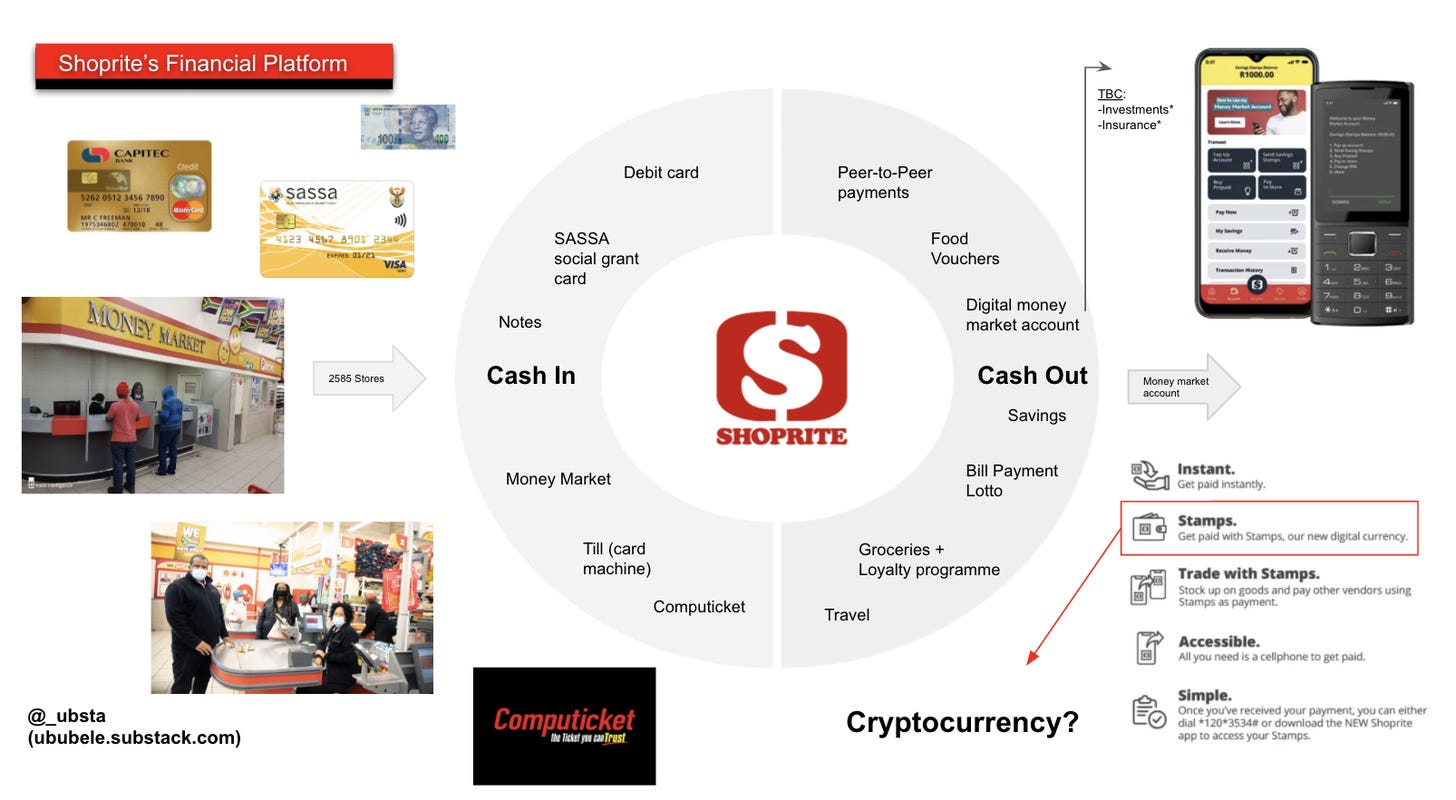

In 2006, on the strength of their Money Market kiosks in 400 Shoprite stores, Shoprite launched a domestic remittance service in Partnership with Capitec Bank. The new service allowed customers to send up to 5000 rands per day & 25000 rands per month (in line with prepaid limits in South Africa) for 9.99 rands a transaction to any of the 400 in-store Money Market kiosks, undercutting banks by 50%.

In 2009, the world was in a global recession but Whitey & his Shoprite produced an 11.9% growth in sales totalling 33 billion rands & trading profit was up 17.5% to 1,6 billion rands.

The 2010s – Largest Retailer In Africa, Whitey Leaves The Building

The 2010s brought more growth for Shoprite. There’s a famous saying by Bidvest founder Brian Joffe, where he says “Bidvest does not partake in recessions”. I think that line applies to Shoprite. Shoprite under Whitey Basson did not partake in recessions. In bad times they did good, in good times they did great. In 2011, Whitey acquired Metcash Cash & Carry (remember he bought Grand Bazaars from Carlos dos Santos in 1991). MCC operated 150 stores under the Friendly & 7Eleven brands, those stores were integrated into the OK Franchise.

By 2012 Shoprite became the 92nd largest retailer in the world & the largest in Africa. Whitey doubled down on the Africa expansion strategy opening a store in Kinshasa, DRC.

2013 was the start of a tough couple of years in their Rest of Africa markets, which saw Shoprite exiting a couple of markets. This did not slow down the group opening a record 13 stores in a day, passing 1 billion transactions in a year at the rate of serving 83 customers per second & revenue topping 130 billion rands in 2016.

Unfortunately, 2016 would be Whitey’s last year at the helm of Shoprite. He had served as CEO for 38 years & grew tired of the media ridiculing his exorbitant salary (50+ million rands a year), the constant change in regulation & the declining economic environment took a toll on the old man. Whitey retired at the end of December 2016 with a golden handshake of 1 billion rands. Thanks for playing.

Shoprite was in good shape when Whitey left, now led by Pieter Engelbrecht the group increased revenue & market share. By 2019, the Shoprite Group was the 86th largest retailer in the world.

The 2020s – Shoprite Holdings & The Future of Financial Inclusion

Towards the end of 2019, the Group as a whole started to prioritise value-added services in South Africa. In November, Checkers launched a grocery delivery service called Sixty60 & a loyalty card programme called Checkers Xtra Savings card. The Checkers Xtra Savings card signed up 1 million people in 72 hours & 5 million people within the first 6 months. In October of this year, The Shoprite-Checkers Group launched the Xtra savings card to Shoprite customers, signing up 1 million people within 72 hours at a rate of 400 people a minute.

They are doubling down on retail. Launching K’nect stores, small stand-alone stores focused on serving low to middle-income customers. From entry-level smartphones to financial services. Why stores? because this gives them an opportunity to upskill their customer base & perhaps pre-load the Shoprite Money Market App with each smartphone sale. Distribution, that’s why.

Shoprite Holdings has built the distribution over 40 years that allows them to gain instant scale of any product.

This is where I input my beliefs:

Financial inclusion is defined as having access to available & equitable financial services as & when needed. In the digital age, people view financial inclusion as the ability to partake in the digital financial ecosystem. So what happens is that people have created apps to provide all sorts of financial instruments; peer-to-peer payments, instant loans, bill payments, virtual cards etc. All valiant endeavours in a much needed time. The problem now is that gaining scale takes time & financial inclusion can’t afford to wait for unit economics to make sense or LTV/CAC ratios to be clear. In the meantime, these costs are subsidized by investors as startups gain scale.

On the flip side, you have Shoprite, who has the existing infrastructure in the form of Money Market kiosks that operates as defacto bank branches; a business model indirectly impacted by access to financial services; the prowess to onboard customers very quickly & the licenses to operate any financial service they want to; why would they not just go full time into banking?

I believe to build with financial inclusion in mind in a cash-based society, you don’t start by moving the mass-market off cash onto a digital-only platform. Rather you make it easy for them to move between cash & digital. Make cash-in/cash-out easy.

Cash-in/Cash-out

At the end of the day, a cashier ‘cashes out’ all the money ‘cashed in’ via transactions for goods purchased during the day. But I believe the term comes from Hannes van Rensburg’s book with the aforementioned title. In general, retailers have taken this method to a new level signing up banks & using the till as a de facto ATM where customers can load & withdraw money at the point of sale.

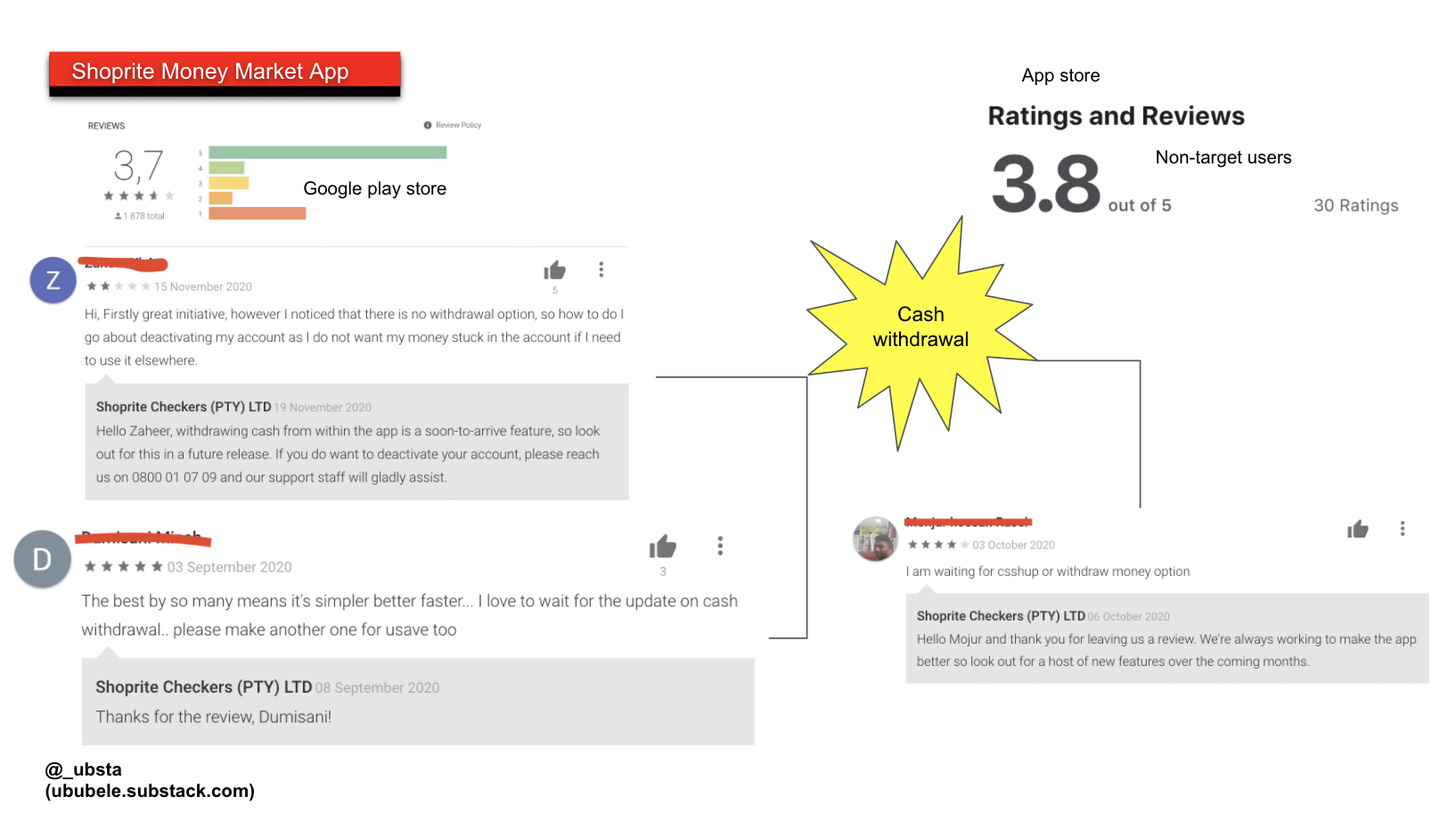

Shoprite & other retailers aren’t ignorant about where the world is going. They understand that someday soon most transactions will be predominately digital so they must plan accordingly by building a robust cash-in/cash-out solution in the form of the Money Market Account. This new account relaunched in August allows Shoprite to be the customer’s digital on-ramp & off-ramp for cash & therefore the first contact for digital financial services.

Making it easy for customers to move between physical notes & digital without bridging the gap with a card sounds counterintuitive for a truly digital world but it makes sense for financial inclusion. At the end of the day, the financial system is built on trust & who better to build trust with customers than the company that gives them freedom of choice between notes & digital? Backward thinking because that is exactly what a bank does. But unfortunately, banks cannot subsidize their core product just to sell more consumer goods. & they can no longer grow by building new bank branches. They need another way to reach customers? my advice to them would be to start selling food inside existing branches ( I’m joking of course).

So why can’t Shoprite subsidize a part of banking & financial services as a method to drive more spend? & by virtue, making sure millions of people are financially included. I find it funny that in my head financial inclusion is the by-product of more capitalism.

At the end of the day, whether people like the Money Market Account app or not, they still want to be able to withdraw cash – for now.

Take Care.

References:

Meet Whitey Basson (the retail guru who turned Shoprite into a R127bn behemoth)

Christo Wiese: Rags to Riches by TJ Strydom